My year in review, and some thoughts for the year ahead.

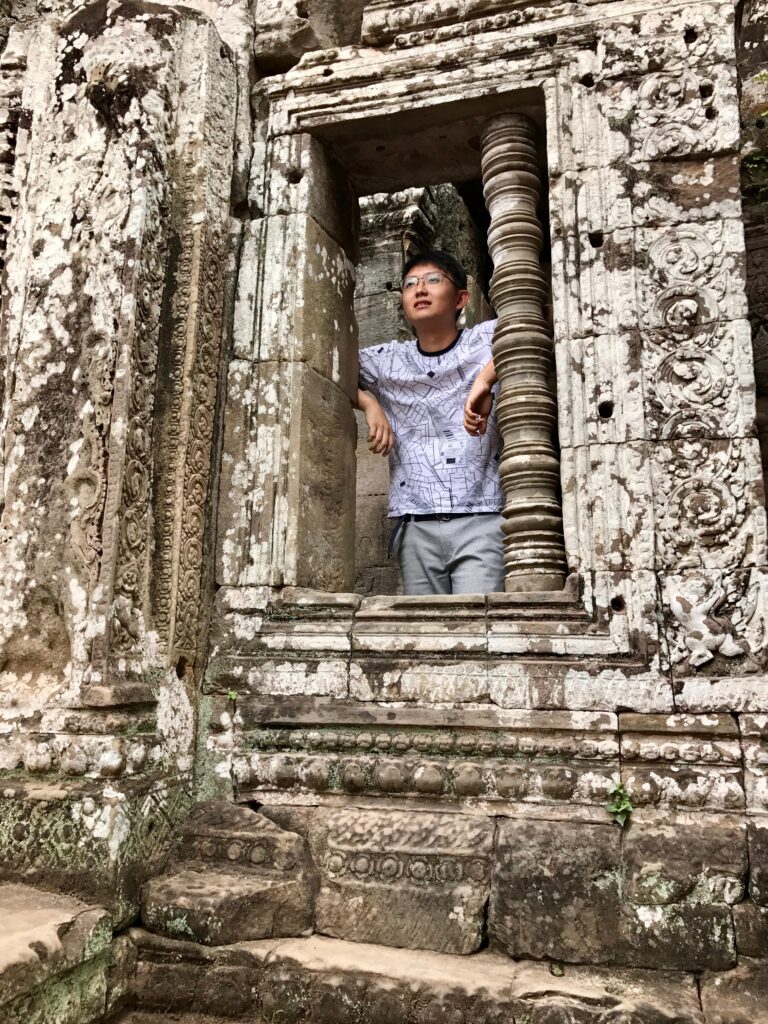

Today marks the 3rd day of the new year. I write this aboard my flight back from Cambodia, where I’ve spent the past few days exploring everything in between Khmer ruins and Cambodian beaches and urbanity of Siem Reap, Sihanoukville, Koh Rong and Phnom Penh. It’s an annual ritual most of us conduct to reflect upon the past 366 days, so as to guide myself better in the next 365. I’m doing this publicly because I consider it an important exercise in transparency and accountability to my family, friends, partners and investors — in an era where our very notions of privacy in a hyper-connected world are being challenged, and where the nature of work is evolving with the research and development of faster, better and cheaper technologies across the colliding wave fronts of self, society, religion, politics and technology. It also forces me to stop and think about the stuff I’m working on and its impact on the world around me.

Before I get started, I also wanted to share my recent reading list for added context. I recently completed 2 books; former technocrat hustler virtuoso Phillip Yeo’s biographical book “Neither Civil Nor Servant”, and Joshua Cooper Ramo’s “The Seventh Sense”. I’m still trying to finish “The Silk Roads: A New History of the World” after making slow progress over the past few months. I also came across 2 links shared by my friend Jeff Jonas; former Head of Civil Service Peter Ho’s speech at a recent conference titled “Disrupted Balance — Society at Risk”, and a forward-looking trends deck by Centre for Strategic Futures. I also clipped Professor Tommy Koh’s recent op-ed on Straits Times on his three great expectations for 2017. Their content serves as my latest brainfood in reflecting upon 2016 while keeping an eye on the rest of 2017.

I continue to juggle my many hats and expect this to continue for the rest of my life; on the professional front as an investor, entrepreneur and all-round startup hustler in the technology realm across China and Southeast Asia, and on the personal front, as a husband and new father of our third child. It’s physically exhausting and mentally invigorating, but my wife and family’s support keeps me highly motivated.

On the Professional Front

I continue to oversee the US$5 million “Neoteny 2” Neoteny Labs fund that I started with Joichi Ito in May 2010, but it no longer takes up much of my time. We returned US$6.76 million at the end of our fourth year (Q4 2014), and continue to have an unrealised portfolio valued at ~US$17.8 million as we approach the end of our sixth year (Apr 2017). Noteworthy investments from our remaining portfolio include Formlabs, littleBits, BlackStorm Labs, Animoca, HelloSign and Burpple. I don’t foresee any exits from the portfolio in 2017, but also don’t expect any write-offs.

I remain the Executive Chairman of the Silicon Straits Group and oversee its continued growth with the rest of our management, Jonas Eichhorst, Kent Nguyen and Andy Bui. Over the past 3 years, the Silicon Straits Group has evolved into an innovation tribe in Southeast Asia that makes early-stage investments and works with entrepreneurs and enterprises to build products and companies. We achieved this across 4 entities; Silicon Straits Pte. Ltd. (Singapore parent group holding), Silicon Straits Foundry Pte. Ltd. (Singapore revenue centre subsidiary for Vietnam team), Silicon Straits Sai Gon, Ltd. (Vietnam revenue/cost centre subsidiary for Ho Chi Minh team) and SmoothOps (Asia) Pte. Ltd. (50% subsidiary providing finance, admin and ops services).

- We reached a record revenue year for Silicon Straits Foundry — more than doubling from FY2015 — ending the year with more than 90 people in Ho Chi Minh, with delivered products, teams and incubated startups across Singapore, Vietnam and Indonesia. Noteworthy projects include 7-Eleven Vietnam (from scratch, all of the tech!), Bluebird Indonesia (uberization of a traditional taxi fleet), Tankfind and ParcelPerform.

- We scaled back on our physical presence in Singapore, ending our lease at Block 71 due to my disinterest in playing the incubation ‘numbers game’ with JTC. It was a great home base while it lasted, but much of our opportunities and growth is outside of Singapore anyway. Having said that, we made a couple of new investments into startups in Singapore (Carro, ParcelPerform, PolicyPal and SurePark), India (One Eight Technologies) and USA (Udu, Pixel Labs being Razmig’s post-Viki startup).

- Our other operating affiliate SmoothOps continues to operate out of the same Block 71 office now inherited by TNB. I also made the decision to sell back 20% of our stake in the business to my partners Sandra and Helena, leaving Silicon Straits with 30% in SmoothOps. Their team has been a great help to our group on the finance, admin and ops front as we scaled across Southeast Asia, and I’m really grateful for their support.

- We’re planning to do a better job on the Silicon Straits website in Q1 2017; you know the drill…not enough time for our own stuff as we drown in client and partner product design and development.

- We continue to explore opportunities to expand our direct presence and partners in Indonesia and Myanmar in 2017, with an eye on growing a second product engineering team out of Singapore.

I remain as one of the board members in Burpple, having seen it through its Series A fundraising in late-2015/early-2016. It’s been a long and productive relationship between Dixon, Daniel and myself from their earliest of days. I still recall the pen-on-tissue discussion we had in 2011 that resulted in me leading their seed investment in 2012. We interact frequently on strategy, product and growth management. It has also been great to see the Series A investors —Tembusu, Singapore Press Holdings and Triumph Capital — jump in, challenge assumptions and actively add value; the team certainly appreciates the added perpectives to help them scale greater heights in the coming year.

I remain as one of the board members of E14 Fund, a pro-bono role that Alexander Lourie, Mark Masselink, John Underkoffler and I undertook back in 2014, after I had consulted for Joi and MIT Media Lab to help set it up. Dave Strand retired and the team/strategy is currently undergoing reframing and alignment with the rest of the MIT.

I ended my role with GreyOrange after 3 years of association; initially as an advisor from Oct 2013 till May 2013, and later on with an operating role from Jun 2015 till Oct 2016. I devised and executed upon their Japan entry, grew the sales pipeline in Asia Pacific/Japan (APACJ) and built the APACJ team out of Singapore. I deepened personal connections with new and old friends; Wolfgang Höltgen who is GreyOrange’s earliest angel investor, Sriram Sridhar who was a trusty right-hand sales lieutenant that hustled with me, my old Carnegie Mellon and Stanford school mate Xianyi Wu who has fit right in driving the company’s product and interface design across Singapore and India, and Nalin Advani who I first got to know from TiE Singapore and joined as CEO (APACJ). Looking back, I underestimated the complexities and dynamics of an Indian-headquartered logistics robotics startup trying to attract and keep talent, maintain product cohesion and quality while entering ex-India markets with different norms, realities and competitors in Japan and China. GreyOrange co-founders Samay, Akash (and myself) were bummed as I had expected to continue contributing for longer, but I ultimately felt I had checked enough boxes, our family was welcoming our third child and that it was time for me to rebalance my overall commitments.

I had a brief interlude with Formlabs for 3 months to serve as the bridge for the expansion of their China efforts — market strategy, business development and talent acquisition — disengaging after having gotten them off to a running start. As an investor in Formlabs through Neoteny Labs’ seed investment in late-2011, I was glad to have had the chance to interact with the team on a more personal and professional level; Maxim Lobovsky, David Lakatos, Luke Winston, Scott Papenfuss and Gideon Balloch. The company has an awesome product in Form 2 and is well-poised for continued growth in North America, Europe and Japan. China is an entirely different beast though, one that will require a seasoned and local team to take it on by its horns. I look forward to more good news from Team Formlabs!

Towards the end of 2016, I added the fintech feather to my cap, assuming the role of Chief Strategy Officer of Beijing-headquartered fintech company Wecash, and serving as their regional partner for our Southeast Asia expansion, starting with Indonesia. Founded in 2014, Wecash develops big data and machine learning technologies for unsecured institution-to-peer loans underwriting between funding sources (banks and multi-finance companies) and consumers. The company has raised over US$40 million and has a team of over 400 across China, USA, Brazil, Singapore and Indonesia. Wecash checked 2 key boxes for me; Indonesia and fintech. I also developed a strong rapport with and respect for Wecash founder George Zhi. Over the past 3 months, I’ve been learning from and collaborating with the Wecash Beijing team while assembling our initial Indonesian team. Our battle plans are crystallising and I’m confident 2017 is going to be a busy but exciting year for the Wecash Southeast Asia team.

On the Personal Front

On the family front, we welcomed our third child, Keidi Chan (second daughter) to our burgeoning young family of 5. I continue to be indebted to my wife who remains my biggest pillar of support as I jet between Singapore and Ho Chi Minh, Jakarta, New Delhi, Tokyo, Beijing, Shanghai, Shenzhen, San Francisco and Boston. Despite my crazy travel, I’ve only missed 4 or 5 weekends with the family in 2016; it’s a personal commitment I made to our family. She has inspired, motivated, cajoled and harangued me to be a much better man and person, and I am really thankful for her persistence and patience at my nonsense.

On the personal front, I have borrowed heavily from my personal time in 2016 for work and family. In that sense, my “personal account” is completely bankrupt and it’s been an extremely tiring (albeit fulfilling) year. I don’t have time to exercise, and don’t feel like I’m spending enough time with my wife and the family. Ultimately, we can’t have it all; I made my choices and shouldn’t really complain. For 2017, I strive to strike a better balance between myself, family and work.

On the Non-Profit Front

Last but not least, I’d like to give special mention to a non-profit project I contributed to in 2017. Apart from authoring an article to the inaugural edition of The Birthday Book titled “Pulling the (virtual) world to Singapore” as my response to the 2016 edition’s prompt, “What is Singapore’s Next Big Thing?”, I (through Silicon Straits) also donated S$25,000 to The Birthday Collective to fund the print runs of the first 3,000 copies of the book, and participated in its planning and organisation alongside Malminderjit Singh, Aaron Maniam, Kah Gay Ng and Daniel Ong. I see this as a natural projection of my aspirations for a more mature and participatory civil society in Singapore; one that is less self-entitled, complains less and takes on a greater onus to own our country’s issues and act on them, rather than expect for all our solutions to be provided by our government. Governments can’t run like tech startups do in Silicon Valley. A more dynamic and participatory civil society can strengthen our nation’s responses to a less-certain future. We’re going to incorporate The Birthday Collective as a CLG legal entity to hold the proceeds from book sales. We’re not quite ready to be a charity or IPC just yet, but want to operate legitimately and be in a better position to accept future contributions. We’ve completely sold out our initial 1,000 copies and are well into our next 2,000 copies. I think we might even be at break-even by now. We’ve also commencing work on the 2017 edition, having finalised this year’s prompt and an initial list of possible contributors. One thing we’ve done better in the new year is to get started earlier; the 2016 edition took us a harried 3 months from start to end, but we should have a good 8 months for the 2017 edition. Look out for our launch sometime in August 2017!